- info@northmansterling.com

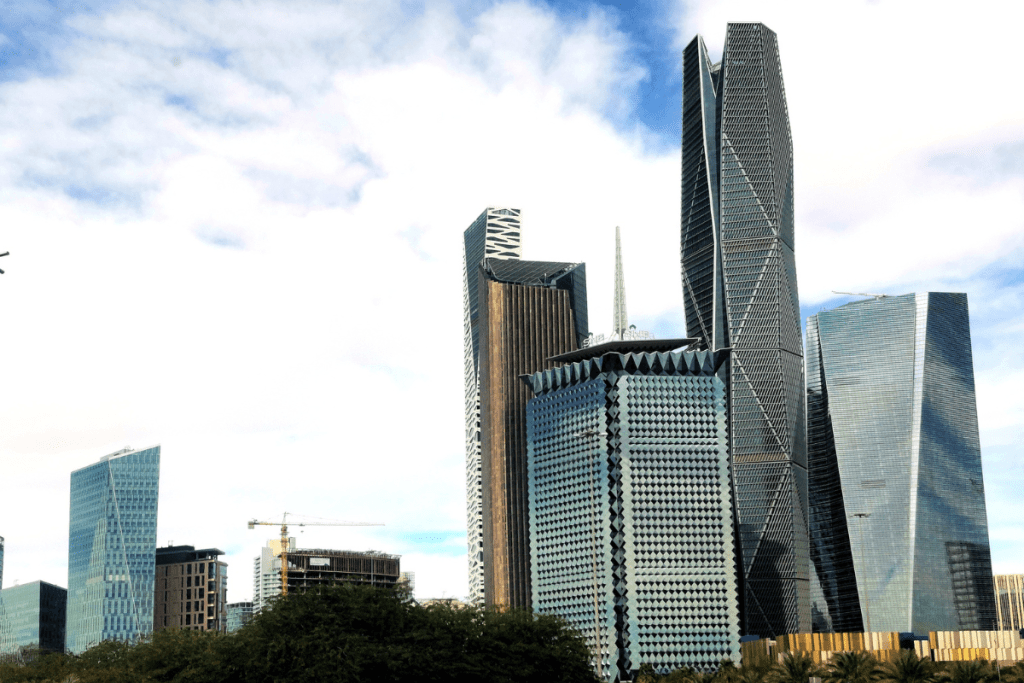

Saudis Reform Investment Law in Bid to Attract Foreigners

Saudi Arabia is taking significant steps to enhance its investment landscape by reforming its law. The changes aim to attract foreign investors and boost foreign direct investment (FDI) to $100 billion annually by 2030. This reform is part of Saudi Arabia’s Vision 2030 plan, which seeks to diversify the economy and reduce reliance on oil by encouraging foreign investments in various sectors.

Key Highlights of the New Investment Law

The updated investment law, approved by the Council of Ministers, is designed to provide greater transparency, flexibility, and confidence to investors, both domestic and international. Here are some of the critical aspects of the new law:

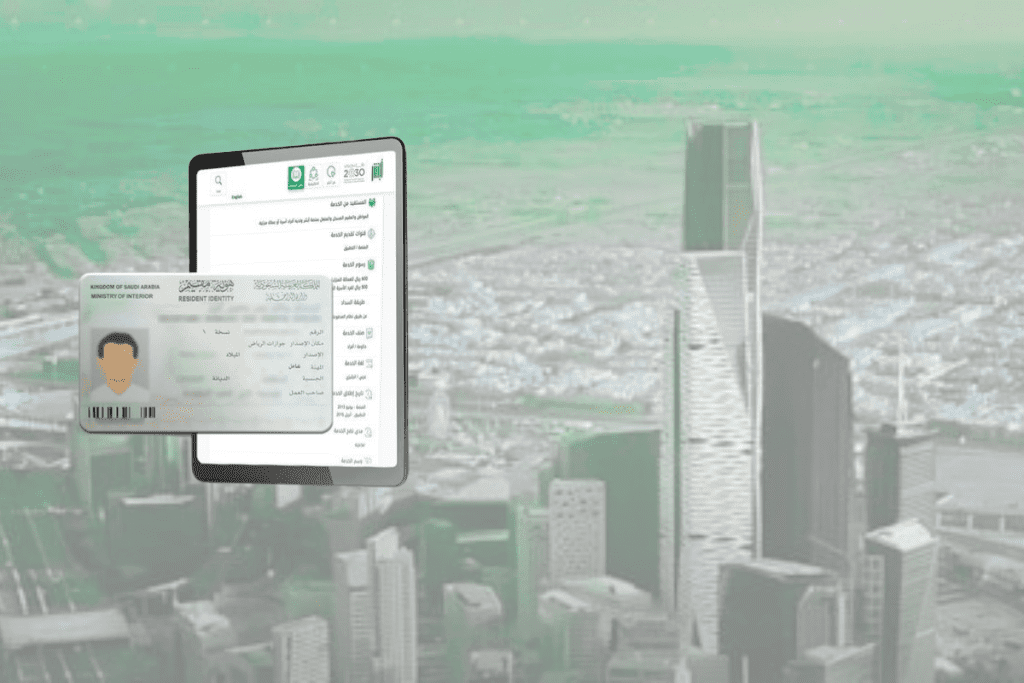

- Simplified Registration Process: The new law replaces the current foreign investor licensing requirements with a simplified registration process, making it easier for foreign investors to enter the Saudi market.

- Equal Treatment: The law aims to level the playing field by ensuring equal treatment between domestic and foreign investors under similar circumstances. This move aligns with international practices and fosters a fair competitive environment.

- Incentives for Investors: To attract investments, the law outlines incentives based on specific, objective, and pre-announced eligibility and evaluation standards. These incentives are expected to encourage both domestic and foreign investors to participate in Saudi Arabia’s economic growth.

- Protection of Investors’ Rights: The law emphasizes the protection of intellectual property, fair competition, and effective dispute resolution methods. This focus on investor rights aims to build confidence and security among investors.

- Service Centre for Streamlined Procedures: A new service centre will be established to facilitate government transactions and assist in streamlining the flow of investments. This initiative aims to enhance the overall investment experience by reducing bureaucratic hurdles.

Saudi Arabia's Vision 2030: A Strategic Move

Saudi Arabia’s Vision 2030 plan is a strategic roadmap for the kingdom’s economic transformation. By reforming the investment law, the kingdom aims to attract foreign funds for its giga-projects and boost its non-oil gross domestic product (GDP). The updated law is expected to drive economic growth by fostering a welcoming and secure environment for investors.

According to Khalid Al Falih, Minister of Investment, “The law reaffirms Saudi Arabia’s commitment to creating a welcoming and secure environment for investors, driving economic growth, and enhancing the kingdom’s position as a premier global investment destination.”

Recent FDI Trends and Future Goals

The kingdom’s efforts to improve its business environment have already shown promising results. FDI inflows into Saudi Arabia reached $19.3 billion last year, marking a significant increase from $7.46 billion in 2017. The kingdom recorded a 0.6% year-on-year increase in FDI inflow to 17 billion Saudi riyals ($4.5 billion) in the first quarter of 2024.

Saudi Arabia aims to increase FDI to 5.7% of GDP by the end of the decade. The updated investment law, set to take effect in 2025, is a crucial step toward achieving this ambitious goal. By creating a more transparent and investor-friendly environment, Saudi Arabia hopes to position itself as a leading global investment destination.